A Comprehensive Guide to Navigating Offshore Service Formation Effectively

In the world of worldwide entrepreneurship, creating an offshore business offers both intricate difficulties and unique chances. Selecting the perfect territory is the first critical action, calling for a cautious equilibrium of lawful stability, desirable tax policies, and economic safety. As possible financiers browse through the intricacies of lawful and regulatory structures, understanding the nuances of each can make a substantial difference in the effective establishment and durability of an offshore entity. What complies with are essential factors to consider and critical approaches that can help in enhancing the advantages while decreasing the risks involved.

Selecting the Suitable Offshore Jurisdiction

When picking an offshore jurisdiction for business development, several crucial aspects need to be considered to guarantee lawful compliance and functional efficiency. Taxation policies are extremely important; some jurisdictions provide reduced or zero tax obligation rates, which can be very beneficial commercial retention. One must also examine the political security of the area to stay clear of potential risks that can impact business operations negatively.

In addition, the credibility of the territory can considerably impact the understanding of business worldwide. Selecting a jurisdiction with a strong governing reputation may promote smoother service relationships and banking deals internationally. Furthermore, the convenience of working, including the simpleness of the enrollment process and the accessibility of knowledgeable neighborhood services, should be evaluated to make sure that the operational demands are sustained successfully.

Comprehending Lawful and Regulatory Frameworks

Having thought about the ideal overseas territory, it is similarly crucial to comprehend the lawful and governing structures that control service operations in these locations. Different countries provide varying degrees of governing oversight, which can dramatically affect the performance and legitimacy of your organization tasks. It is crucial for financiers to understand the details lawful needs, including taxation legislations, personal privacy policies, and compliance obligations that each jurisdiction requireds.

Lawful structures in offshore jurisdictions are frequently created to draw in foreign financial investment via economic motivations such as reduced tax prices and streamlined reporting procedures. These advantages can come with strict regulations intended at avoiding money laundering and monetary scams. Investors must browse these legislations thoroughly to avoid lawful pitfalls

Understanding these structures needs complete research or consultation with lawful professionals aware of global service law. This action makes sure that business follows all legal requirements, securing its procedures and track record around the world.

Developing Your Offshore Business Framework

After recognizing the legal and regulatory frameworks essential for overseas company procedures, the following crucial step is to establish the appropriate company structure. Common frameworks include International Organization have a peek here Firms (IBCs), Minimal Obligation Business (LLCs), and partnerships.

Inevitably, aligning business framework with calculated company objectives and the selected territory's offerings is necessary for enhancing the benefits of overseas consolidation.

Handling Compliance and Taxes in Offshore Operations

Taking care of compliance and taxation is an essential element of keeping an overseas company. This includes recognizing the effects of double tax contracts and figuring out whether the organization certifies for any type of exceptions or rewards.

Local business owner need to likewise spend in robust compliance programs that include routine audits and worker training to promote business governance. Engaging with legal and monetary professionals that specialize in worldwide company legislation can give very useful support and assistance browse the complexities of cross-border tax. Offshore Business Formation. These browse around these guys experts can assist in establishing efficient tax obligation structures that straighten with global methods while maximizing fiscal commitments

Eventually, thorough monitoring of compliance and taxes is crucial for guaranteeing the lasting success and sustainability of an offshore venture.

Final Thought

Finally, the effective formation of an offshore company joints on cautious consideration of territory, legal compliance, and the ideal organization structure. By meticulously picking a desirable and steady atmosphere, understanding and adhering to legal frameworks, and taking care of continuous conformity and tax, companies can establish themselves efficiently on the international stage. This strategic method makes certain not only operational legitimacy yet likewise positions business for sustainable growth and lasting this content success in the worldwide market.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Pierce Brosnan Then & Now!

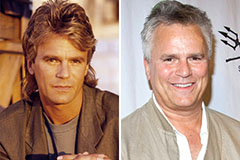

Pierce Brosnan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!